The SPF assesses an administrative fee, with a minimum of $30, on each project or program that uses the fund. This is a one-time assessment taken at the time of the deposit.

There is also an “Inactivity Fee” of an additional two percent on the balance in any account for which there is no deposit activity during the SPF year, January 1 to December 31.

Note that the average administrative fee charged by non-profits is between 18 and 22 percent, and it is assessed annually. The SPF fee is minimal compared to other non-profits

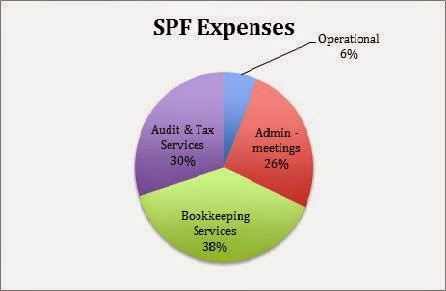

- 30% professional audit and tax preparation services

- 38% professional bookkeeping services

- 26% general administrative expenses associated with board meetings and meetings with the accountant and bookkeeper (travel, housing, etc.)

- 6% operational expenses (PO Box, postage, software, phone, etc.)